Most workers who aren’t saving for retirement through their employers aren’t saving at all, the study found

New data suggests the average American worker has under $1,000 saved for retirement.

A report from the National Institute on Retirement Security found that the median savings for all employed adults between the ages of 21 and 64 were approximately $955. The study includes workers with 401(k) and other retirement savings plans, as well as the approximately 56 million workers who do not have access to employer-sponsored retirement plans.

Workers with retirement savings plans have a median balance of approximately $40,000 saved, according to the report. That figure is nowhere near the $1.5 million that Americans say they need to feel comfortable fully retiring.

I sure wish I had 955$ saved!

JFC this is depressing. Hopefully it forces some change though. I like that post about the French boyfriend asking why we don’t burn shit. Hunger will make people burn shit.

6 meals away from anarchy or sumthin

Real talk!

well the solution is simple: deport brown people, ban trans people and give more money and tax cuts to corporations and billionaires. it’ll all be over soon.

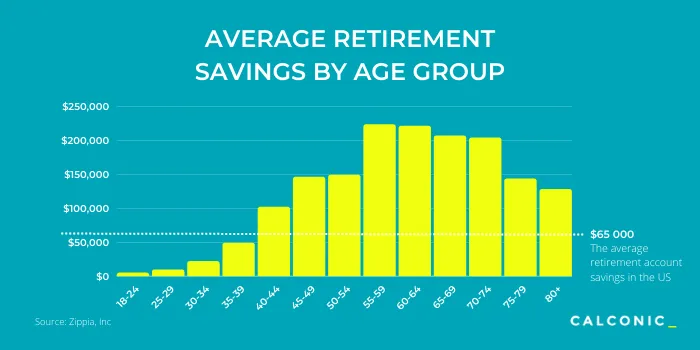

This is a terrible stat. Taking the people who are entering the workforce and averaging them with people who have spent a lifetime working. Not only that, but that’s just “retirement” savings. How many 20 year olds have retirement accounts?

The information would be far more realistic if it were grouped by decade of life.

Edit: Here. This is a little better

Savings

Retirement savings

If by “average,” they mean “mean,” that’s not a useful figure, since it’s skewed by the disproportionate rewards going to the rich. And that’s what that chart looks like. There’s no way that the median for US people in their 60s is anywhere near $200k unless that involves some bullshit like imputing an NPV to their social security entitlement.

OK, so I did some searching.

Here’s a more informative set of stats and charts: https://dqydj.com/retirement-savings-by-age/

The age 60-64 median according to their more rigorous methodology is $10,400, not $200k.

Still very bleak. Nobody is retiring comfortably on $60k, much less $10k.

Might be worth factoring in SS, as that’s the real practical retirement savings people rely upon.

The $60k represents remaining savings at age 80-89.

Look at the 60-69 column for what people have around the time they start retiring. But not that those are means, not median figures, so are skewed by the US’s vast levels of inequality.

Still seems scarily low, especially for the USA.

Also skewed by those that will have millions.

Median, not average, so much better at showing this situation than mean but it’s still not great. I agree that it should be broken up, but the difficulty is how you define the grouping will have a significant impact on the results, especially in early and later years.

I’d prefer median by age graphed by age. Average by any grouping will skew heavily if there is a lot of variance, and I absolutely expect there is in the US. A box-and-whisker plot could also be ideal here, but you still have the grouping problem.

It’s relevant context to know that while about 67% of people self-report that they are living “paycheck to paycheck” (meaning they are not actively saving any money), only 30% self-report that they are actually spending more than 90% of their income on necessities.

Point being that the majority of people who aren’t actively saving, are choosing not to, spending all of their extra income instead of saving at least some of it.

As bad as conditions are overall, a significant chunk of people are making it needlessly worse for themselves, and things are not quite as dire as they’re made to seem by sensationalist media that’s quick to report that 67% figure, but never focuses on the 30% one that’s a much better indicator of the percentage of people who are actually having trouble making ends meet.

Necessities vary a lot by what you can afford. Internet and cell phone is pretty necessary and if you put off repairs and even renovations it can be worse long term. healthier or higher quality food. whats the long term cost of eating regular eggs vs pastuer raised. I mean there is definately a nutrient difference. What about your kids education. Anyway im just saying necessity is a very slippery slope. Air is a necessity over water which is a necessity over calories which is a necesity over vitamin C. retirment savings are long term and need to be balance with other things like home ownership and health.

In my group of friends I describe what I feel related to this as, obsession with youth/fear of aging, and consumerism/tourism rebranded as spirituality/wellness/experiences

Yea, just what people want to do. Spend basically on only necessities for years/decades just so they may have an opportunity to retire. Sounds like a great plan.

That’s a straw man, so I’m not going to bother responding beyond pointing out the fallacy. Consider engaging with what I actually said.

I’m pretty sure I did. Where do you think the money for retirement comes from? Whatever they are spending on non-necessities. Sure, some people can do that without completely forgoing luxuries, but we’re talking about the low end of income here. For any meaningful retirement, and that’s a maybe, it really is forgoing any nicities for a long time.

It would have taken a lot longer for me to build the capital for a down payment if I wasn’t frugal. It helped me save and invest a little extra each month.

That in no way is the definition of a straw man.

Did you just make the Avocado Toast argument?

No. Also I specifically used the ‘90% of their income’ figure and not the 95% one shortly mentioned thereafter, because I think it’s fair that even those who are struggling the most ought to be able to have some ‘fun’ with their money.

But most people do earn enough to pay for their necessities, have fun, and save. And many people don’t save for later, even though they easily can, in the name of putting more on the ‘fun’ pile.

While I think, technically, strictly correct, the big question wild be how much they could realistically “save”, and in such a hypothetical, would it really be significantly more encouraging results.

Our, realistically speaking we are generally already looking at that reality, with people putting aside a relative pittance but still feeling that they live paycheck to paycheck, largely ignoring anything that goes toward retirement.

I get it, I’ve had relatives buy stupid expensive pickups or muscle cars with obscene payment plans while barely keeping their heads above water, but even the more careful ones barely scrape by.

Social Security was the single greatest transfer of wealth from employers to employees in US history

Sounds like a good thing

That’s why the Repulicans hate it so much.

Fucking high rollers over there

My retirement plan is to die at work, that way my family is taken care of. (who am I kidding, my work will try to weasel out of paying them if that happens)

Learn from the French: burn shit before you get to the point of starvation.

I mean, it took starvation for them to start burning shit the first time. But at least they learned from that, and haven’t let it get as bad since then.

This is simply Americans’ first time experiencing the wrong side of the “let them eat cake” thing, so of course it’ll take a long time for America to start lighting things on fire.

Removed by mod

Your family will be lucky to get a pizza party.

The pizza dough contains potassium bromate which may be carcinogenic

“He worked so hard, we loved him. Were like family here. KThxBye.”

Don’t tell the ultra wealthy! They’ll start the ploy to “recover” what they’re missing out on. Usually by funding systems to convince voters to elect someone who’ll get it for them the fastest

Lots of people saying it’s a skill issue that people aren’t saving more of their earnings. The problem is much deeper: it doesn’t make sense for the majority of Americans to save their money. This is the rational outcome of a political and economic system that does not offer hope, only cynicism.

If it was a handful of people, it could MAYBE be a skill issue. But when it’s most people, it’s a systemic issue.

I had an argument about that with the college when I failed ochem. 2/3 of the students failed ochem that year. My argument was basically they made the tests too hard just to weed people out because I aced the lab class and always had As on my papers. Papers where you performed real world calculations not insane ones. There reply was basically yeah its a weed out class take it again or switch majors but we’ll let you keep your scholarship… for now. Kept major, switched schools a year later then switched majors.

I had several 401ks, I cashed them out fairly quickly because an emergency would come along and it was the only thing between me and homelessness, or not receiving medical care.

Now I have a 403(b) because I work for higher ed, and I am forbidden to cash it out, but I’ve taken a loan against it and paid off my credit cards, and am paying myself interest now.

So now I have my CCs freed up for the next time I have an emergency, which will be checks watch

I had almost completely strip-mined my 401k and post-tax investments by the time I was 56 due to a family member’s mental-health crisis and the downstream impact of that (it was worth it: the family member in question is now stable and thriving). I’m now 70 and should be able to retire next year if some other emegency doesn’t bite us on the ass before then. It took 14 years to rebuild, and that was with my wife and me both bringing in professional salaries and having additional investments.

I feel the “checking watch for next emergency”

I’m just about done paying off my last emergency so I’m right on time for the next big one. Fate seems to wait until I’m spitting distance from paying it off to taunt me or some shit.

The last time I was literally 1 month from having it paid off before BOOM $10k medical emergency and to not become homeless due to said medical emergency combined with being on FMLA for 12 weeks minus a day.

It don’t like like a lot to some but for me it’s been hell.

I’m not from USA so I don’t know what rates of interest your banks offer, but most here offer less than 4%, so there doesn’t seem much point for a few hundred quid.

In the retirement account front, just checked and for the past year it hit 19%, over the last 10 years, it’s been 15% a year. Generally those are biased toward stock and move to more conservative close to retirement. I think that’s generally the balance being considered, at least if you have any retirement account, it’s probably larger than any other account in short order.

For “savings” account recently 4% has been available, but less so now as the central bank turns down interest rates to favor borrowers again. But I don’t think they are limiting to strict savings accounts here. I think money put into an index fund or bonds or CDs would absolutely count.

Most private workplaces offer retirement investment accounts, that seems to be more what they mean.

Our lavish lifestyles include paying for food, shelter, healthcare, power and water and it keeps costing more and more but there’s record shareholder profits!!! Yeah! You should be happy that the economy is great for pedofiles who rape children and possibly(checks notes) eat babies on yachts. Cool! they’re openly using all our tax dollars with the goal of making us working people obsolete while mass surveilling us and killing dissenters in the streets. Awesome

This is Lemmy. You can say pedophile. You can swear. You can call spades a spade without doing wrongspeak that censors you from the algorithm.

I think a bunch of people on here genuinely don’t know how to spell the word.

Garbage.

Tell me the average of all people who have more than zero (and the number that represents), then tell me how many have zero.

This number 955 doesn’t mean shit.

Very misleading stats. What’s the breakdown by age group? A 21-year old with <$1000 in savings is very different from a 64-year old. Talking about the “average worker” across that wide of an age range is totally meaningless. What’s the median age?

I mean 21 to 64 of all employed adults. I doubt there are so many 21 year olds that they are tipping the scales to under a grand on their own. Theoretically the mean should be especially relevant to the middle of the spectrum. I can say im later than that and drawing down savings over the last year as I have been out of work. I keep saying I know there are gonna be these articles about how gen X did not save enough for retirement and its going to be like sigh. I tried as much as I could when I could.

Well I think employed 21-year olds are a lot less likely to have any savings at all (mostly student loans) and also more likely to be working in a job with no retirement plan (working at Subway or Starbucks). Combining their situation to a 64-year old in an office job or a skilled trade is still pretty misleading.

Yes, it’s a huge problem that young people have all this student debt and lack of savings and high living expenses. But we’re not going to be able to analyze that by lumping all their numbers together with older people. If we want to make comparisons we need separate numbers.

yeah I mean even if you take 0 for them that would bring down an equivalent number of folks with 2k and we know the opposite situation occurs with c suite folks and such having real high numbers. Even then if it is 20somethings it still highlights an issue we have now that was not the case 50 years ago. 20somethings can’t save at all. 30somethings if they are lucky can start to save but kinda want a house someday so wants to save some in a regular way (which is also smart. its very important to have a short term savings no matter the tax advantage of retirement savings). It they are lucky maybe they can swing the mortgage in their 40’s but that puts a damper on retirement savings as well given mortage payments. So like 50’s you can finally really start socking it away for your impending retirement. again if you are lucky.

If your employer offers a 401(k) match, not trying to take advantage of that is one of the absolute dumbest financial moves you can make. Yes, I understand people sometimes can’t that’s why I said “try”.

Another move is not investing early. The biggest boost to wealth in retirement is start saving early to take advantage of compounding interest.

I’ll upvote for the “try”. Most people I know in tight spots need the money NOW. They are barely thinking 1 year ahead let alone 40.

I know people like that too. Those same people don’t know how much they spend on anything, don’t know where their money is going, and waste money on entertainment (subscriptions), drugs/alcohol, it other stupid shit. I wish they were more aware of their personal finance because I’d hate to see them when they’re 55 trying to figure it out at the last minute.

I’m pretty broke all the time, i absolutely know where all of it’s going:

- bills

- groceries

- paying off debts from my young and dumb days.

6 more months and i get to have a clothing and sundries budget again

Honestly, comparing my finances to most of the people who have complained to me in person about living “paycheck to paycheck” the majority of people are trying to live middle class on working class incomes. I was guilty of it too, lifestyle creep happened.

I shake my head every time I see people overspending on consumer bullshit while complaining about cost of living like their $20/day for energy drinks is reasonable.

I will say this. It annoys me when I see stuff like. Well these folks are stupid so they deserve it. I have definately known folks who can’t do whats necessary to not be messed up in the us and its part of the reason we need real social democratic systems and safety nets. The us has this thing expecting everyone to be a jack of all trades for everything and being smart about every aspect of life. Everyone can’t be a doctor, a lawyers, an accountant, a mechanic, and a all the various trades needed to properly handle property. I mean look whats expected with our taxes. Its nuts. Any society should run such that people can work a job and blow their paycheck every week and still do fine. Maybe not high on the hog but have food and shelter and healthcare and transportation and education if they need it. Because if we don’t we are going to just create a bunch of problems that then get duct tape type solutions which is pretty much what you see in the us.

They have never wanted us to retire. They want us to work until we die.

workers will not be allowed to work until they die unless its a really menial job. Every normal mundane mistake you make as an older worker, your bosses look at you trying to decide if you are too old to do the job.

I wouldn’t be surprised to find out that due to the political climate, this total is lower than it was, say between 2009-2017.